Infrastructure as an asset class for directors

Home > Event > Project Seven Co-Due Diligence Exercise

Enhancing Investor Capacity

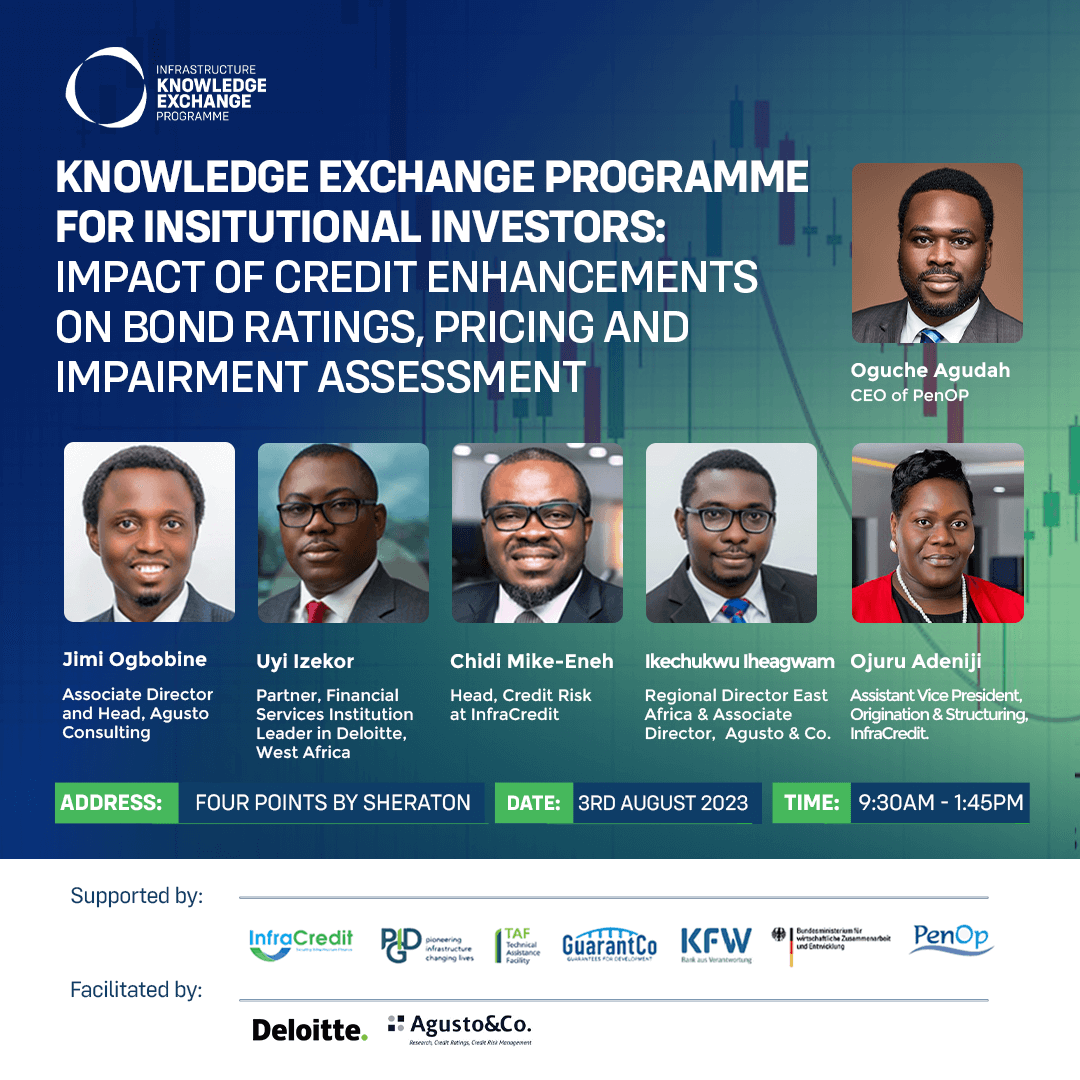

IIt is generally believed that investor capacity building will play a critical role in unlocking the potential for sustainable long-term infrastructure finance by strengthening investors’ analytical skills to evaluate and invest in infrastructure assets. Ultimately, the programme is expected to generate increased investment in bankable infrastructure assets, support the development of risk-sharing appetite among long term investors, thereby deepening the Nigerian debt capital markets.

About Infrastructure

Capacity Building Programme

The Infrastructure Capacity Building Programme is a multi-donor funded programme, supported by

InfraCredit’s Development Partners and Pension Funds Operators Association of Nigeria (PenOp),

was initiated to build a strong collaboration among key stakeholders in the Nigerian investment

community that will engender increased private sector participation in infrastructure finance in

Nigeria. Infrastructure Training is one of the three key initiatives adopted by the Programme to

achieve its strategic objectives. This course is one of series of training courses organised under the

Programme.

Since its inception in 2017, the Infrastructure Capacity Building Programme has completed seventeen

(17) trainings and trained six hundred and fifty five (655) stakeholders representing sixty six(66)

institutions

Methodology

The Infrastructure Capacity Building Programme is a multi-donor funded programme, supported by InfraCredit’s Development Partners and Pension Funds Operators Association of Nigeria (PenOp), was initiated to build a strong collaboration among key stakeholders in the Nigerian investment community that will engender increased private sector participation in infrastructure finance in Nigeria. Infrastructure Training is one of the three key initiatives adopted by the Programme to achieve its strategic objectives. This course is one of series of training courses organised under the Programme.

Since its inception in 2017, the Infrastructure Capacity Building Programme has completed seventeen (17) trainings and trained six hundred and fifty five (655) stakeholders representing sixty six(66) institutions

Sessions

Infrastructure Investment in Nigeria and Sub-Saharan Africa

- Characteristics and Performance of infrastructure Investments

- Infrastructure Investments Compared to Traditional Assets and Investment

- Projects and Infrastructure Players in Nigeria and Broader Africa

- Examples of Power, Transport, Water, Sanitation and Other Undertakings

Risk Analysis and Cashflow Forecasts

- Financial Modelling and Cash Flow Analysis for Infrastructure

- View of Lenders: DSCR and PV Coverage

- Equity Considerations: IRR and NPV

- Evaluating the Cost of Capital

- Project Returns vs. Equity Returns

- Forecasting Techniques and Limitations

- Probabilistic vs. Non-Probabilistic Model-Building

EVENTS DETAILS

.

- Start Date:

- End Date:

- Time:

- 10:00am - 12:00pm

- Address:

Please enter the start date

Please enter the start date

ORGANIZERS

.

- Name:

- Email:

- Phone:

- Website:

SPONSORS & MEDIA PARTNER

.