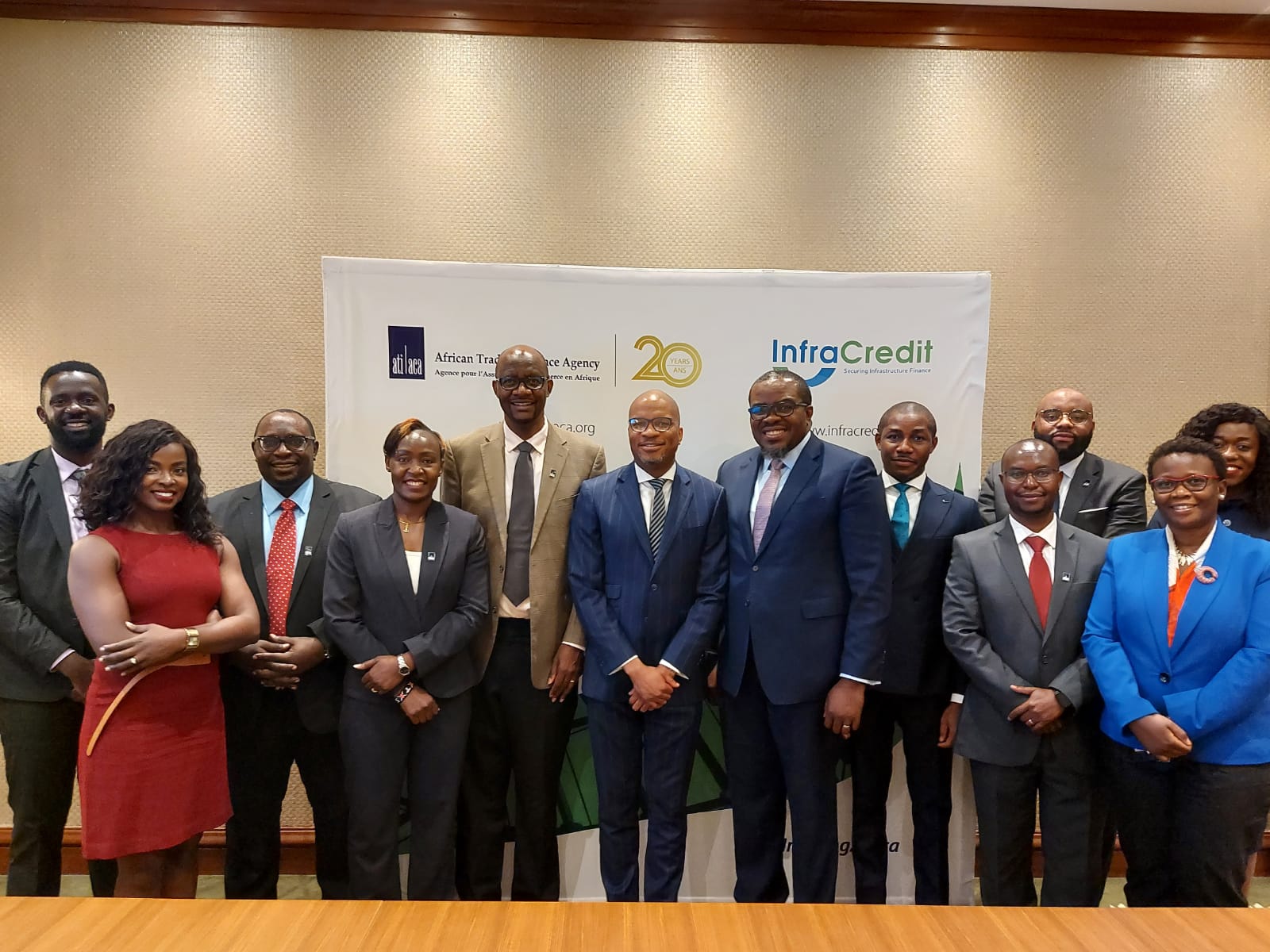

InfraCredit and the African Trade Insurance Agency (ATI) sign a memorandum of understanding on cooperation as risk-sharing partners to deepen access to long-term local currency debt financing for infrastructure in Nigeria

InfraCredit, a specialised infrastructure credit guarantee institution in Nigeria and the African Trade Insurance Agency (“ATI”), a pan-African multilateral development finance institution that provides risk solutions, have signed a Memorandum of Understanding (“MoU”) on Cooperation as risk-sharing partners to unlock access to long-term local currency debt financing for infrastructure development in Nigeria

Under the MoU, InfraCredit and ATI will collaborate and work together as risk-sharing partners, within the context of their respective mandates, policies, resources and instruments, to provide credit guarantees, co-guarantees and counter-guarantees/reinsurance, as applicable, on eligible infrastructure financing transactions. ATI would be providing re-guarantees and other risk solutions to InfraCredit-backed transactions, as additional credit enhancement, which would enhance the underwriting capacity of InfraCredit and serves as additional comfort to investors.

As a demonstration of the potential impact of their strategic partnership, InfraCredit and ATI recently entered into a risk sharing arrangement on a 10 year 10-billion-naira infrastructure bond (US$24 million equivalent). The bond was issued in February 2022 by a Nigeria based digital telecommunications infrastructure company, a first-time issuer in the debt capital markets. InfraCredit provided a first loss guarantee for the infrastructure bonds, while ATI provided a second loss counter guarantee on 50% of principal repayments on the bonds to InfraCredit. The infrastructure bond was rated “AAA” by Agusto and Co. and GCR, and was oversubscribed by domestic pension funds.

Speaking on the occasion of the signing of the MoU in Nairobi, the Chief Executive Officer of InfraCredit, Chinua Azubike, stated that “One of the vital strategies of InfraCredit towards addressing the significant infrastructure financing deficit in Nigeria is to grow our guarantee capacity through risk sharing partnerships with development finance institutions like ATI, by leveraging their capacity to share our long-term risks. The success of our initial risk-sharing transaction serves as a strong demonstration effect of the potential impact. Our aim is to scale up towards underwriting larger infrastructure projects and mobilising more domestic credit from local institutional investors to support key priority infrastructure sectors in Nigeria.”

Speaking during the event of the signing of the MoU, Manuel Moses, the Chief Executive Officer of ATI, noted that: “Infrastructure development remains a major challenge in Africa and ATI is enthused to enter into this partnership with InfraCredit. We intend to support the acceleration of investments across the sector, which is a bedrock and an enabler for productivity and sustainable economic growth on the continent. This risk sharing agreement will not only deepen and strengthen our strategic relationship with InfraCredit but it will also provide an opportunity for mobilising financing in local currencies for infrastructure development, building a better Nigeria for tomorrow.

ENDS –

For further enquiries, please contact:

Infrastructure Credit Guarantee Company PLC

Media Enquiries: [email protected]

Guarantee Enquiries: [email protected]

Phone: +234 6312300