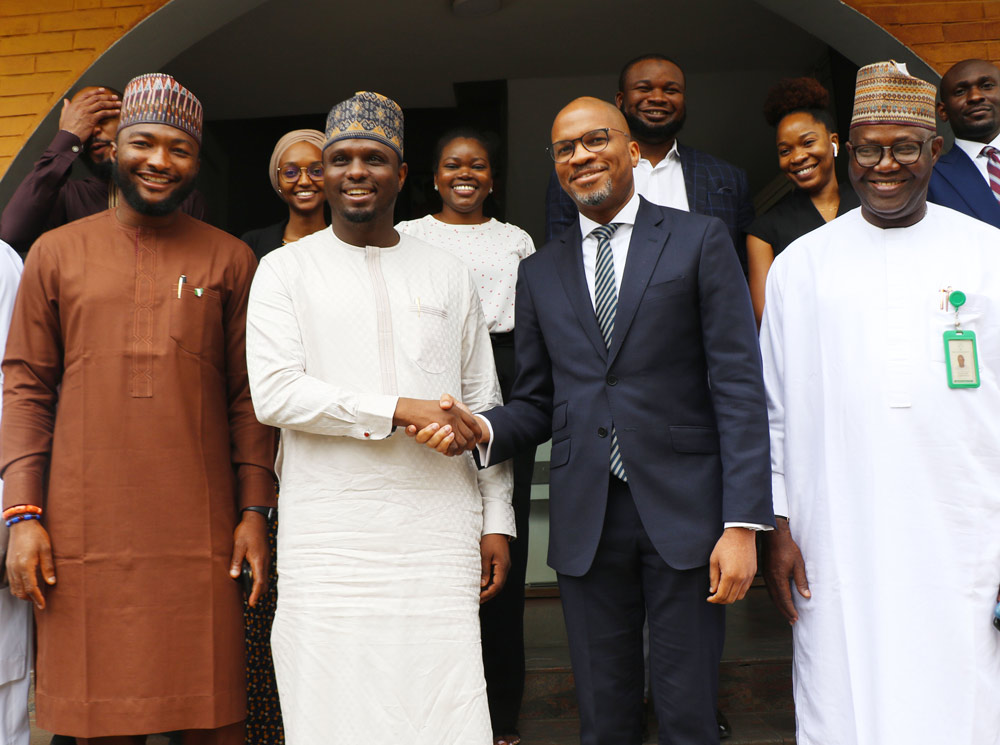

InfraCredit, Rural Electrification Agency Sign Memorandum of Understanding on Cooperation to Deepen Access to Long-Term Local Currency Debt Financing for Rural Electrification in Nigeria

InfraCredit, an ‘AAA’-rated specialised infrastructure credit guarantee institution and Rural Electrification Agency (“REA”), a rural electrification government agency established to implement, provide, and support decentralized electrification in Nigeria, have signed a Memorandum of Understanding (“MoU”) designed to deepen and strengthen the strategic partnership between InfraCredit and REA through the Solar Power Naija Programme in a bid to catalyse long-term local currency debt investments into the Nigerian solar off-grid space.

Under the MoU, InfraCredit, a key stakeholder in the nation’s financial sector and an institution with a robust history of unlocking potential for long-term local currency infrastructure finance in Nigeria will collaborate with REA to work alongside its Solar Power Naija (SPN) programme within the context of their respective mandates, policies, resources, and instruments, to provide financial support and credit guarantees, as applicable, on select eligible off-grid infrastructure financing transactions. The potential catalytic impact of this strategic partnership is the elimination of long-term financing bottlenecks for off-grid operators in the energy sector by enabling credit enhancement and financing to private sector mini-grid developers to enable adequate power generation and supply to underserved and unserved areas.

Speaking on the signing of the MoU, the Chief Executive Officer of InfraCredit, Chinua Azubike, stated that “InfraCredit is committed to working with credible stakeholders such as REA, to deepen access to long-term local currency mini-grid financing in Nigeria. Our collaboration with REA will further enhance our synergy and increase our ability to draw on REA’s complementary networks and credit quality. Notably, this partnership with REA reinforces our commitment to eliminating challenges experienced by lenders and our ability to operate symbiosis with government agencies supporting local currency mini-grid infrastructure financing projects. This innovative, collaborative strategy will further attract new developers in the mini-grid space, improve access to electrification through decentralized solutions, and contribute to clean energy projects in Nigeria.”

Speaking on the collaboration, Engr. Ahmad Salihijo Ahmad, the Chief Executive Officer of REA noted that: “the deliberate strategic partnership with InfraCredit is relevant for the much needed support to private sector players in the off-grid sector. He added that with the quality of the guarantee being provided by InfraCredit under the SPN, developers are able to reach more homes and communities across the nation.

|

|

|

|